Arizona’s manufacturing and infrastructure sectors are feeling the impact of a growing Controls Technician shortage in Arizona. As Q4 ramps up, companies across Phoenix, Mesa, and Chandler are under pressure to complete projects, RFPs, and compliance deliverables while competing for a limited pool of qualified Controls Technicians.

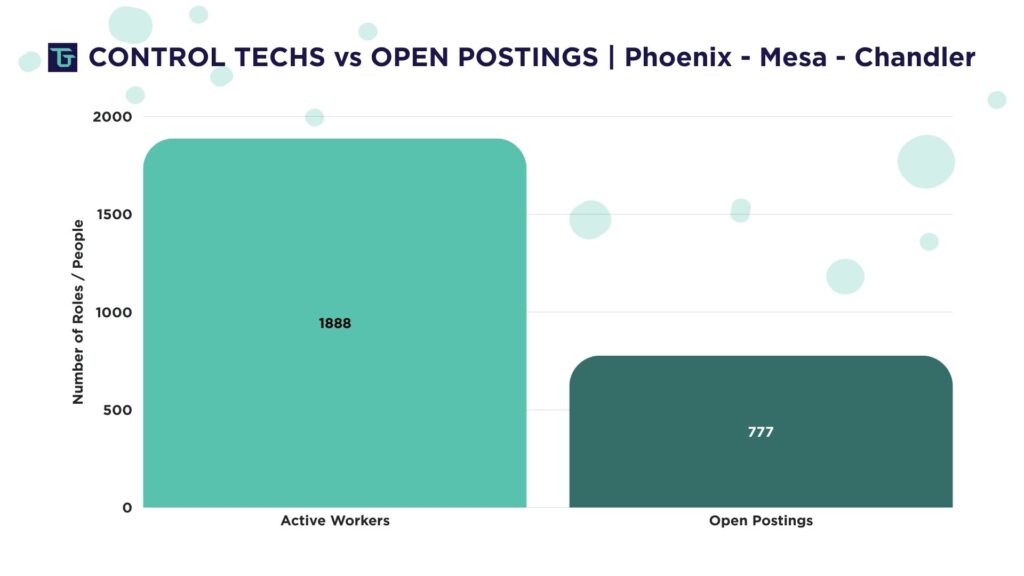

According to Lightcast Q3 2025 data, there are only 1,888 active professionals in this job family across the Phoenix–Mesa–Chandler region, yet 777 open postings across 243 employers. That is nearly two jobs for every available hire, a clear indicator that demand has outpaced supply.

If your civil and transportation teams are also feeling this pressure, see our related perspective on Civil Engineering Hiring in Arizona: How to Bridge the Talent Gap

The Data: A Tight Market in Phoenix–Mesa–Chandler

Lightcast data shows that Arizona’s Controls Technician workforce is 29 percent more concentrated than the national average, which signals specialization but not enough slack to fill current openings. Median pay sits at $38.46 per hour with a typical range of $32.69–$44.23 per hour, and unemployment within this group is 4.3 percent. Major employers such as Intel and Honeywell continue to compete for the same limited pool of Controls and Engineering Technicians.

For broader leadership context on building teams during shortages, review our guide: How to Build a Strong Tech Team in Arizona

Why the Shortage Peaks in Q4

1. Preventative maintenance season

Industrial and semiconductor facilities use year-end slowdowns to perform major system checks and repairs. With limited Controls staff, even scheduled maintenance can create compliance and safety risks. Well-structured maintenance programs can reduce unplanned downtime by 44 percent and safety incidents by 87 percent.

2. RFP and project closeouts

Civil and infrastructure firms push to complete QA reports, as-builts, and RFP submissions in Q4. When headcount is already thin, these deliverables can become bottlenecks. Local media have also noted continued delays tied to technical labor shortages.

3. Escalating wage competition

Larger employers are increasing wage offers to secure limited talent. Lightcast pay data confirms Phoenix’s median wage at $38.46 per hour, about 4 percent above the national average, with the upper range approaching $45–$52 per hour.

For roles that require discreet outreach and precision screening during crunch periods, consider a retained approach. See Beyond the Job Post: Why Retained Search Delivers Better Technical Talent

What Employers Can Do Now

-

Benchmark wages realistically. Offers below $30–$37 per hour may not enter the candidate conversation in today’s Phoenix market.

-

Leverage contract staffing. Short-term workforce support can bridge gaps during maintenance, QA, or project submission cycles.

-

Start 2026 workforce planning early. Waiting until January is already too late to build an effective hiring pipeline.

If you are weighing contingent versus retained models for hard-to-fill technical roles, this overview can help: Beyond the Job Post: Why Retained Search Delivers Better Technical Talent

Arizona Tech Hiring Trends: 2025 Outlook

To understand the broader hiring landscape, consider how technical recruiting dynamics are shifting across Arizona’s manufacturing and infrastructure sectors in 2025. This wider view helps contextualize the Controls Technician shortage in Arizona, offering insight into workforce pressures, talent migration patterns, and competitive hiring strategies.

The Controls Technician shortage in Arizona is not just a hiring challenge. It is a productivity and project-delivery risk that affects every phase of operations, from preventative maintenance to RFP execution. As infrastructure, semiconductor, and advanced manufacturing demand rises into 2026, proactive workforce planning in Q4 will determine who meets deadlines and who falls behind.

Data Source: Lightcast Q3 2025 Report — Electrical and Electronic Engineering Technologists and Technicians, Phoenix–Mesa–Chandler, AZ.